To be depreciable, the property must meet all the following requirements. You can depreciate most types of tangible property (except land), such as buildings, machinery, vehicles, furniture, and equipment. You can also depreciate certain intangible property, such as patents, copyrights, and computer software. Residual value, salvage value and scrap value mean the same thing. They refer to the value of an asset at the end of the useful life. A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation.

Income Statement

You bought a building and land for $120,000 and placed it in service on March 8. The sales contract showed that the building cost $100,000 and the land cost $20,000. Although your property may qualify for GDS, you can elect to use ADS. The election must generally cover all property in the same property class that you placed in service during the year. However, the election for residential rental property and nonresidential real property can be made on a property-by-property basis. For qualified property other than listed property, enter the special depreciation allowance on Form 4562, Part II, line 14.

What Are the Different Ways to Calculate Depreciation?

- Beginning Net Book Value of the asset is $40,000 (we haven’t taken any depreciation yet. The asset is new.) We multiply the Beginning Net Book Value by 2 x Straight Line rate of 40% to arrive at the first year depreciation amount.

- Finally, because the computer is 5-year property placed in service in the fourth quarter, you use Table A-5.

- The examples below demonstrate how the formula for each depreciation method would work and how the company would benefit.

They received an $800 trade-in allowance for the old ovens and paid $520 in cash for the new oven. In April, you bought a patent for $5,100 that is not a section 197 intangible. You depreciate the patent under the straight line method, using a 17-year useful life and no salvage value. You divide the $5,100 basis by 17 years to get your $300 yearly depreciation deduction.

Calculating Depreciation Using the Straight-Line Method

Special rules apply in determining the passenger automobile limits. These rules and examples are discussed in section 1.168(i)-6(d)(3) of the regulations. The maximum depreciation deductions for trucks and vans placed in service after 2002 are higher than those for other passenger how to calculate depreciation rate % from depreciation amount automobiles. The maximum deduction amounts for trucks and vans are shown in the following table. John Maple is the sole proprietor of a plumbing contracting business. As part of Richard’s pay, Richard is allowed to use one of the company automobiles for personal use.

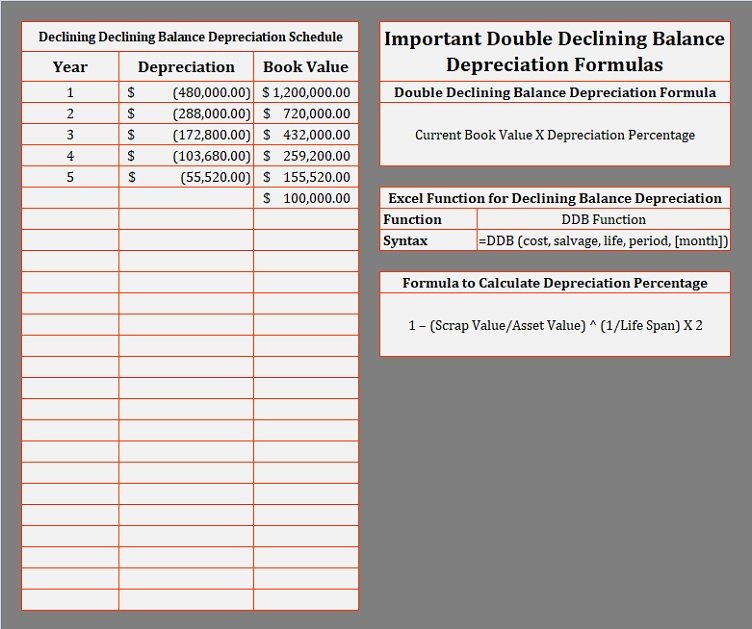

Effects of the Declining Balance Method

If the double-declining depreciation rate is 40%, the straight-line rate of depreciation shall be its half, i.e., 20%. Unlike the straight-line method, the double-declining method depreciates a higher portion of the asset’s cost in the early years and reduces the amount of expense charged in later years. For example, if an asset has a useful life of 10 years (i.e., Straight-line rate of 10%), the depreciation rate of 20% would be charged on its carrying value. This method is an essential tool in the arsenal of financial professionals, enabling a more accurate reflection of an asset’s value over time in balance sheets and financial statements.

Your depreciation deduction for the year cannot be more than the part of your adjusted basis in the stock of the corporation that is allocable to your business or income-producing property. You must also reduce your depreciation deduction if only a portion of the property is used in a business or for the production of income. Property with a long production period and certain aircraft placed in service after December 31, 2023, and before January 1, 2025, is eligible for a special depreciation allowance of 80% of the depreciable basis of the property.

This is important for accurate financial reporting and compliance with… The articles and research support materials available on this site are educational and are not intended to be investment or tax advice. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Is a form of accelerated depreciation in which first-year depreciation is twice the amount of straight-line depreciation when a zero terminal disposal price is assumed. Note that the double-declining multiplier yields a depreciation expense for only four years. Also, note that the expense in the fourth year is limited to the amount needed to reduce the book value to the $20,000 salvage value.

If you place property in service in a personal activity, you cannot claim depreciation. However, if you change the property’s use to use in a business or income-producing activity, then you can begin to depreciate it at the time of the change. You place the property in service in the business or income-producing activity on the date of the change. You begin to depreciate your property when you place it in service for use in your trade or business or for the production of income.

It is not confined to a name but can also be attached to a particular area where business is transacted, to a list of customers, or to other elements of value in business as a going concern. Travel between a personal home and work or job site within the area of an individual’s tax home. The Taxpayer Bill of Rights describes 10 basic rights that all taxpayers have when dealing with the IRS.