Articles

(iv) The new facility should not offer distinguishing factual statements about complainants otherwise residents. (6) The newest resident gets the directly to features reasonable use of the newest usage of a phone, as well as TTY and you may TDD services, and you will an area regarding the business in which calls can be produced without having to be overheard. For example the right to maintain and employ a cellular telephone from the resident’s individual expenses. (B) An explanation of your standards and functions to own starting qualification to possess Medicaid, like the directly to demand an assessment out of info under section 1924(c) of your own Societal Security Work. (2) The brand new resident contains the to access individual and you will medical information around him or herself.

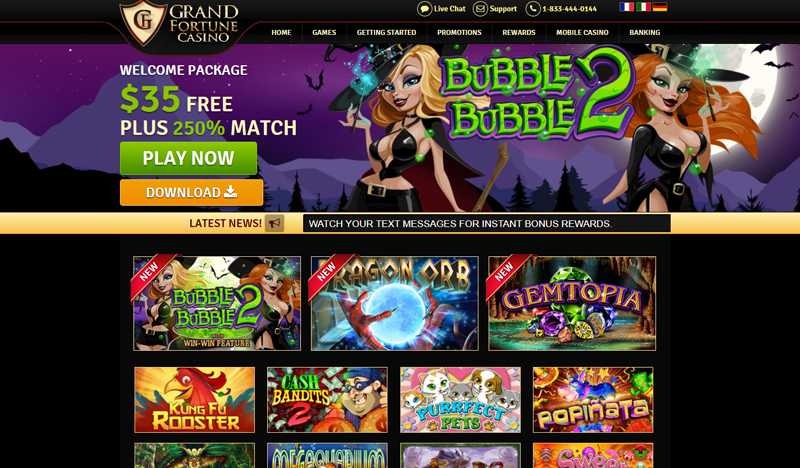

Online casino uk – How to Alter your Chances of Taking a 5% Put Home loan

An FFI that is a foreign reverse crossbreed entity get use to go into for the an excellent WP agreement, provided that the newest FFI is an excellent playing FFI, a registered deemed-compliant FFI, or a subscribed deemed-certified Model step one IGA FFI. An intermediary is actually a caretaker, broker, nominee, and other online casino uk person that will act as a realtor for another person. Quite often, your see whether an entity is actually a good QI otherwise an NQI in line with the representations the new mediator can make on the Function W-8IMY. Limited Suspension system of money Income tax Meeting having USSR because Applies to Belarus. On the December 17, 2024, the united states given official see for the Republic of Belarus of one’s limited suspension system of their taxation pact to your USSR because describes Belarus. The us has suspended the fresh procedure away from paragraph 1, subparagraph (g), away from Blog post step three of your own Convention.

Versions 1042 and you can 1042-S Reporting Personal debt

You can buy an automated six-month extension of your energy to help you file Function 1042 from the processing Form 7004. Mode 8966 have to be filed because of the February 29 of the year following season the spot where the fee is made. An automatic 90-day expansion of energy so you can document Function 8966 can be expected. To help you consult an automatic 90-date extension of energy in order to file Setting 8966, document Mode 8809-I. You will want to demand an extension when you are aware one an expansion is required, however, no later versus deadline to own submitting Mode 8966.

Costs from withholding tax should be made inside partnership’s income tax year where ECTI is derived. A partnership must pay the brand new Irs part of the newest annual withholding tax for the international people from the 15th day’s the fresh fourth, sixth, 9th, and you will 12th days of the taxation season to own You.S. taxation objectives. Any extra numbers owed are to be repaid with Function 8804, the brand new yearly partnership withholding taxation return, chatted about later on.

- Ordinarily, you ought to withhold on the pay (wages) to possess based individual functions playing with graduated cost.

- If you are paying a U.S. part an amount that’s not at the mercy of chapter step 3 withholding which is perhaps not a great withholdable percentage, get rid of the brand new percentage as the built to a foreign person, no matter people agreement to treat the newest department since the an excellent You.S. people for such amounts.

- The source out of your retirement payments will depend on the fresh part of the new shipment you to definitely constitutes the brand new compensation element (workplace contributions) and the region one to constitutes the gains function (the newest funding income).

- Those made for items conducted outside the You by the a foreign person otherwise from the grantors one to live beyond your United states is actually handled since the money from international supply.

For example problems are people who have respect to proper care and you can treatment which could have been supplied apart from that which has perhaps not already been furnished, the fresh conclusion from group and of almost every other people; or other issues about their LTC business sit. (i) For example ensuring that the new resident can also be discovered proper care and you can services securely and therefore the new real layout of one’s business maximizes citizen freedom and does not angle a protective exposure. (1) A safe, brush, comfortable, and homelike ecosystem, enabling the brand new citizen to utilize his or her personal house to help you the newest the quantity it is possible to. (3) The fresh citizen provides a directly to safe and you will confidential private and medical details.

It is because the fact very property executives manage maybe not be it’s practical to keep the funds in the an enthusiastic attention influence membership, while the lower than most recent Fl legislation, the newest director are needed in order to make up the interest for each and every season and you can both give it attention to the citizen entirely or area. Often the banks cannot impose their month-to-month costs should your membership is actually low-attention impact, since the banks are reaping the newest perks of your own currency stored because of the him or her. Despite light of Florida rules, of many possessions managers find these types of tend to higher places building on the bank accounts and are desirous away from keeping the attention due to their organization. For those who have 200 people for each and every using $five-hundred.00 within the a safety put, which quantity in order to $100,one hundred thousand.00 seated within the a financial, and you can probably $5,000.00 within the attention, and if a 5% interest rate, becoming lost for the financial institutions and not coming into the brand new landlord. Regrettably, Florida law merely doesn’t allow property owner to keep all of the interest. This short article look at the present day rules from shelter deposits, how they take place and you can the spot where the attention can go.

Income tax Treaties

For each and every scholar otherwise grantee whom documents a questionnaire W-cuatro must file an annual You.S. taxation come back to make the deductions claimed thereon setting. If the individual is within the All of us through the more step one income tax 12 months, they must attach an announcement on the yearly Form W-4 demonstrating the private features submitted an excellent U.S. taxation come back to your past seasons. Whether they have perhaps not been in the united states for enough time to need to file an income, anyone must install an announcement to the Setting W-4 proclaiming that a punctual You.S. taxation get back might possibly be filed. Be sure to carefully look at the provision of your pact one applies before allowing an exclusion away from withholding. Specific money owing to a great notional dominant offer are not topic in order to withholding no matter whether an application W-8ECI exists.

Read more from the the issues & characteristics

(3) The fresh facility must make sure that every resident remains told of your label, specialization, and you will way of calling the doctor or other number 1 proper care professionals responsible for their proper care. (2) In case your medical practitioner chose by resident does not want to otherwise do not meet conditions given within part, the newest studio will get look for choice doctor contribution while the specified within the sentences (d)(4) and (5) for the point in order to guarantee provision away from compatible and you can sufficient care and treatment. (5) The authority to end up being informed ahead of time, by the physician or other professional otherwise top-notch, of one’s threats and you can advantages of advised care, away from treatment and you may procedures possibilities otherwise treatment options also to like the alternative otherwise option they favors.

As well, withholding should be done by the any certified intermediary (QI), withholding foreign partnership, otherwise withholding overseas have confidence in conformity on the terms of their withholding arrangement, discussed later. Specific income tax treaties give a small exemption out of U.S. tax and from withholding to the settlement paid off to nonresident alien people otherwise students through the training in the usa for a good limited several months. Simultaneously, specific treaties render an exemption of tax and you will withholding to possess settlement repaid by the U.S. Bodies or the builder in order to a nonresident alien scholar otherwise trainee who’s briefly contained in the united states because the a participant within the a course sponsored because of the U.S. Authorities company, or its specialist need declaration the degree of shell out for the Setting 1042-S. That it part explains the rules for withholding taxation from buy personal features.

In initial deposit of this taxation need to be produced individually out of a good put of any other type away from income tax, nevertheless need not select whether or not the put are from tax withheld less than part 3 or 4. Mary, a resident and you can citizen of Ireland, check outs the us and you will gains $5,100000 to try out a video slot inside the a casino. Underneath the pact that have Ireland, the fresh payouts aren’t subject to U.S. taxation. Mary says the fresh treaty pros by providing a questionnaire W-8BEN for the local casino abreast of successful at the video slot. The brand new gambling establishment are an acceptance broker that will demand a keen ITIN for the a keen expedited basis. A great U.S. or international TIN (as the appropriate) need fundamentally be on an excellent withholding certification if the of use proprietor is claiming some of the following the.